L&T Finance (LTF), a financing firm from the L&T stable, said it is expanding its retail lending business pan India to cash in on the rising demand for homes in the urban and rural markets.

The company, which built a home loan book size of ₹18,500 crore in the past more than four years after exiting from wholesale/commercial lending, is targeting to grow its business at 25% year-on-year against the industry average of 10 to 12%, recorded during fiscal 2024.

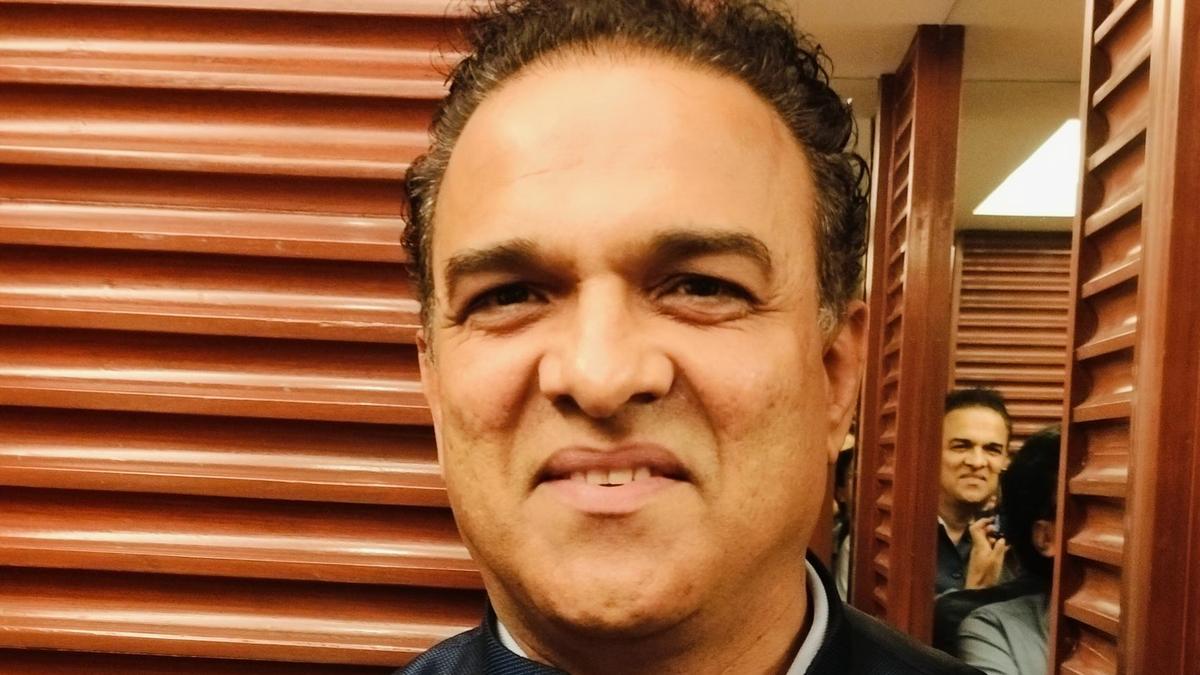

“Home Loan is a low-risk product and gives a lot of stability to the overall portfolio. We intend to get 50 to 55% of our book under a secured loan portfolio, which includes homes, two wheeler, cars, tractors etc. Our current overall book size is ₹80,000 crore, which includes microfinance and tractor finance to the tune of $40,000 crore,’‘ Sudipta Roy, Managing Director and CEO, L&T Finance told The Hindu on Wednesday.

According to Mr. Roy, there is a robust end-user-driven demand uptick in the country’s home market and LTF is now looking at filling the “white spaces [service gaps] missed out by other financiers.” “’Home decor finance is a whitespace today. We also offer a dedicated relationship manager, so that customers need not suffer. Plus, we do digital eligibility checks and offer soft loan clearances in 30 minutes to help customers know their loan eligibility as they are having conversations with builders,’‘ he added. To fill these whitespaces, LTF introduced a new product “complete home loan” in Bengaluru and has plans to take it across to other cities including Ahmedabad, Kolkata, Mumbai, Hyderabad, Chandigarh and NCR, and to small towns, later, Mr. Roy said.

Home market outlook

‘’We see home buying trends gaining momentum all across the country including strong trends in Bengaluru, Mumbai and the NCR. We expect the trend to continue for next three to four quarters if not more,’‘ Mr. Roy added.

Commenting on the inventory overhang, Sanjay Garyali, Chief Executive, Urban Finance at LTF said, Bengaluru saw the lowest home inventory in the 12 to 16 months range, while Kolkata and NCR reported 24 to 26 months, all against the country average of 20 months. “’It is about new launches versus new sales, and new sales should be ahead of new launches. We expect developers to launch new home products across all ticket sizes and segments in the next two to four months,” Mr. Garyali said. According to LTF officials, multiple factors, including the pandemic-triggered longing for comfortable and spacious homes, existence of RERA, availability of quality of products and timely deliveries, are driving the country’s home market . Currently, LTF’s median ticket size is ₹70 lakh and the high-end is ₹7 crore.

1 week ago

100

1 week ago

100