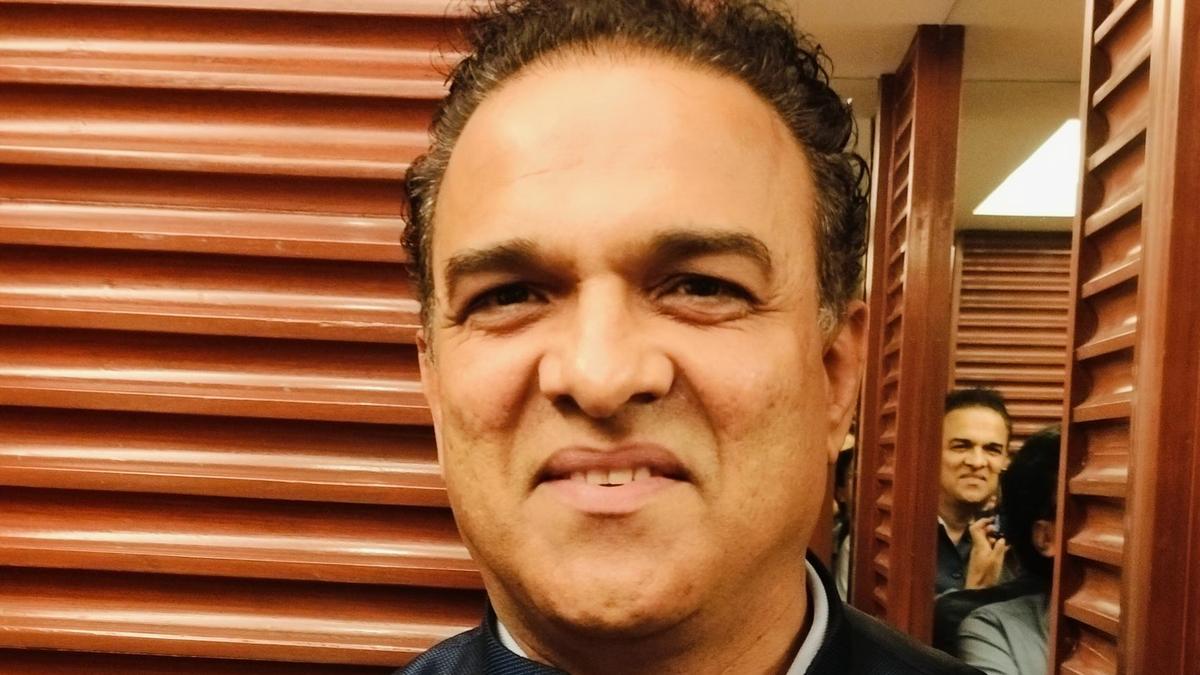

For Nazim Salur, it’s the end of a nearly decade-long dream to build a global delivery powerhouse out of Turkey.

Delivery App Getir’s Rise and Fall Fueled by Billions of Dollars and Strategy Conflicts

Delivery App Getir’s Rise and Fall Fueled by Billions of Dollars and Strategy Conflicts Getir, the rapid grocery app Salur cofounded from Istanbul in 2015, last week confirmed it will exit its remaining international operations.

Unlock exclusive access to the latest news on India's general elections, only on the HT App. Download Now! Download Now!

Once a poster child of pandemic growth valued at $11.8 billion, attracting investors like ex-Sequoia Capital partner Michael Moritz, Mubadala Investment Co., Sequoia Capital and Tiger Global, the startup is halting operations in the Netherlands, the UK, US and Germany to focus on its core market of Turkey. Its last known valuation was $2.5 billion after a fund-raising round last September.

Like other promising tech startups that exploded in the pandemic, Getir benefited from global stay-at-home orders and access to cheap money. The company expanded rapidly from Turkey into Europe and the US and acquired rivals using its venture capital billions. But its business model was tested when economies reopened, interest rates rose and investors began seeking financial discipline over growth.

Lately, Salur has had few options but to withdraw from markets - or else jeopardize his own position - after pressure from investors to cut cash burn and refocus on Turkey, people familiar with the matter said. He has approached at least one party in recent weeks to sell a ride-hailing app, BiTaksi, that he owns together with Getir, so far unsuccessfully, one of the people said.

Mubadala, Abu Dhabi’s sovereign wealth fund, is set to become the company’s biggest backer after agreeing to a fresh round of financing. The fund, along with investor G Squared, has agreed to provide as much as $200 million, said one of the people, who asked not to be identified discussing confidential information. That funding is split into tranches, is contingent on Getir meeting certain targets and may not reach that maximum figure, the person said.

Investors including Tiger Global, Michael Moritz’s foundation Crankstart, G Squared and Sequoia Capital did not return requests for comment. Getir declined to comment. Salur did not return requests for comment.

Tensions between Getir’s leadership and its backers don’t come as a surprise to those who worked there, according to three former employees who asked not to be identified discussing internal company matters.

A blueprint that succeeded in Getir’s native Turkey, where labor and operating costs are low, failed to translate to markets in Western Europe, they said. They pointed to disagreements over strategy between Getir’s all-Turkish leadership and its European managers that led to market withdrawals.

Internally and in interviews, Salur trumpeted his app’s promise of delivering groceries in 10 minutes, shipping these out to customers from urban warehouses via couriers on mopeds or bicycles. “I said, ‘Why don’t I bring people their everyday necessities in 10 minutes,’” Salur told the Slush tech conference in 2021. “It wasn’t anything scientific, I didn’t do market research.”

In practice, 10-minute delivery required hiring lots of drivers and limiting available inventory. The company also set high order volume targets internally, discounting heavily to attract customers.

During a leadership meeting at Getir’s headquarters in late 2022, the company’s international managers argued to soften these targets, saying longer delivery times could cut costs and increase orders. Salur and other Turkish executives were adamant delivery times should stay low, the former employees said.

At the same meeting, Salur decided one way to beat rival grocery apps was to sell one universally popular item very cheap: Bananas. Country managers were instructed to find the cheapest bananas in their market and undercut the price, the people said. The regions argued that this would lose money, since bananas were always popular, and undermine Getir’s efforts to look like a premium convenience brand — but to no avail. The app offered one banana for as little as 9 cents. When managers told Salur in a follow-up meeting that banana discounts did little to drive sales, the chief executive had given up the idea, the former employees said.

Getir’s acquisition of its major rival Gorillas that year was a victory for Salur in terms of seeing off the competition, but contributed to rising costs. Integrating extra warehouses, staff and technology into Getir’s operations was expensive and time-consuming, former employees said. The sector more broadly showed signs of strain as UK delivery startup Jiffy pivoted from rapid groceries to building software, US player Fridge No More abruptly shut down, and Russia-backed Buyk filed for bankruptcy.

By summer 2023, Getir had exited France, Italy, Portugal and Spain and had a cash burn rate of about $50 million a month, Bloomberg previously reported. An exodus of high-ranking staff followed, including the Gorillas chief operating officer and chief financial officer and Getir’s country director for the Netherlands.

Getir’s priority now is Turkey, where its financial performance is stronger and it can upsell consumers on supplementary services like banking and deliveries with a longer turnaround. For those who once enjoyed its services in Europe, its eye-catching yellow and purple delivery scooters are set to become a pandemic memory.

This article was generated from an automated news agency feed without modifications to text.

1 week ago

104

1 week ago

104