May 08, 2024 03:16 PM IST

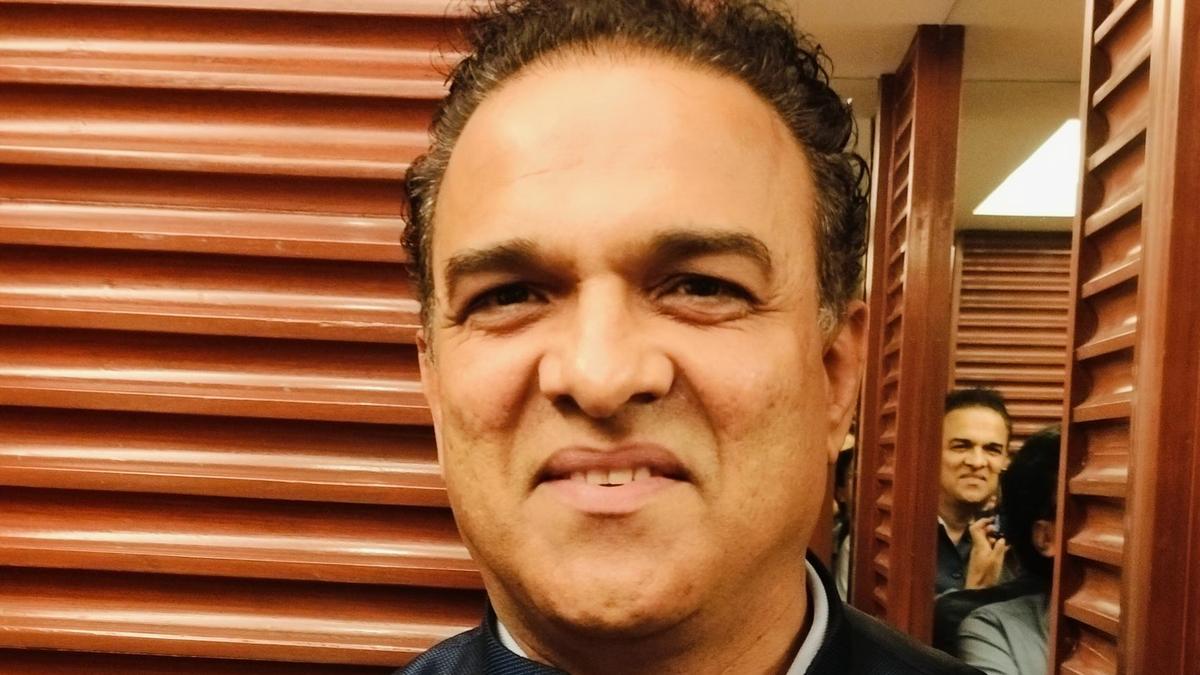

Shankar Sharma said there are stocks that would fall 90% when the market enters a bear phase as the shares of companies laden with excess capital may plummet.

Ace investor Shankar Sharma believes that the single biggest threat that India's stock markets face is overcapitalization driven by the greed of merchant bankers and operators. In a post on X (formerly Twitter), he wrote, “Single biggest threat to this Bull Market are greedy Merchant Bankers & Operators, exhorting foolish promoters to raise excess capital, permanently destroying balance sheets via over capitalisation."

A bird flies past a screen displaying the Sensex results on the facade of the Bombay Stock Exchange (BSE) building in Mumbai.(Reuters)

A bird flies past a screen displaying the Sensex results on the facade of the Bombay Stock Exchange (BSE) building in Mumbai.(Reuters) These are the stocks that would fall 90% in the next bear market, he reiterated.

Unlock exclusive access to the latest news on India's general elections, only on the HT App. Download Now! Download Now!

Read more: Google Wallet app, now in India, isn’t bothered about credit cards or payments

He reiterated that these are the stocks that would fall 90% when the market enters a bear phase as the shares of companies laden with excess capital may plummet.

The remarks come as volatility has gripped Indian stocks owing to a multitude of factors- uncertainty surrounding national elections, persistent foreign selling, elevated valuations and mixed Q4 earnings.

Read more: Economist Gautam Sen on inheritance tax: Unrealistic, will unleash economic chaos

India's volatility index increased by as much as 7.7% to 18.32 and hit a 15-month high for the third session in a row today. Dr V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said, "The India VIX has spiked 72% from the April lows, indicating that high volatility will persist for some more time. It is important to understand that VIX is based on Nifty index options prices."

Read more: Nirmala Sitharaman rebuts Congress on PSUs, says they showed resurgence in Modi regime

He added, “The spike in VIX is due to the rising volume of options trades. Many investors are buying put options to protect their portfolio in case of an unexpected election outcome.”

1 week ago

102

1 week ago

102